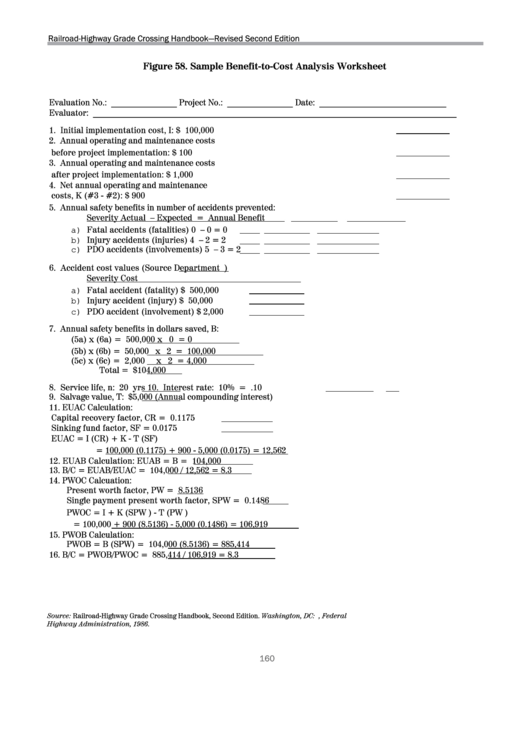

Cost Benefit Analysis Worksheet. When hand-calculating this, it is very important capture the entire significant visitors diversions as a part of this calculation. A company using the money technique of accounting can amortize organizational prices incurred throughout the first tax yr, even when it would not pay them in that 12 months. You must allocate curiosity expense on the loan to non-public use although the loan is secured by enterprise property. In different phrases, as quickly as the financial values for all costs and advantages for a project have been determined, a discount price could be utilized so as to convert future cash move estimates to today’s worth.

The inventory measurement is then used to calculate the Cost of Goods Sold for a corporation. Therefore, traders need to take particular care if there are any massive modifications in COGS as these could be simply modified due to numerous accounting methodologies. As far as accounting is worried, the product costs of the sold merchandise are captured within the revenue assertion, while that of the unsold product is mirrored in the inventory of finished goods.

Worksheet was designed for cognitive restructuring in CBT, or exploring undesirable behaviors in any other treatment approach. Clients are prompted to describe a particular thought or behavior, the prices and benefits of that thought or conduct, and a extra adaptive alternative. The under sections describe an illustrative value and volume change to point out the influence, and what may be thought of when modelled the price impact.

Sensible Recovery Tool: Cost Benefit Analysis Cba

These transfers are thought-about to occur annually, usually on December 31. If you use the loan proceeds in your trade or enterprise, you can deduct the forgone interest annually as a enterprise interest expense. If you’re a companion or a shareholder, you would possibly have to capitalize curiosity you incur during the tax year for the manufacturing costs of the partnership or S company.

Eight in 10 taxpayers use direct deposit to obtain their refund. If you do not have a bank account, go to IRS.gov/DirectDeposit for extra data on the place to discover a bank or credit score union that may open an account online.

Additional Classes

For information about the exception for recurring gadgets, see Pub. You are using quantities paid for certified long-term care insurance coverage to determine the deduction. You can embody premiums paid on a qualified long-term care insurance contract when figuring your deduction.

You can deduct the employment taxes you have to pay from your personal funds as taxes. Generally, that is the 12 months with or within which the tax 12 months that applies for foreign tax functions ends or, within the case of a contested tax, the year in which the contest is resolved. Different rules may apply to find out when a international income tax is taken into account to accrue for functions of the overseas tax credit.

Synergies, the monetary advantages arising from the transaction, can be categorized as either revenue or value synergies. One of the first incentives for corporations to pursue M&A in the first place is to generate synergies across the lengthy run, which may result in a large scope of potential advantages. Taxable income is the portion of your gross earnings used to calculate how a lot tax you owe in a given tax year.

Your taxes can be affected if your SSN is used to file a fraudulent return or to assert a refund or credit score. Choose a tax return preparer it is feasible for you to to contact in case the IRS examines your return and has questions concerning how your return was ready. You can designate your paid tax return preparer or one other third party to talk to the IRS regarding the preparation of your return, payment/refund points, and mathematical errors.

To guarantee we submit authentic and non-plagiarized papers to our purchasers, all our papers are passed by way of a plagiarism check. We even have professional editors who go through every full paper to ensure they are error free.

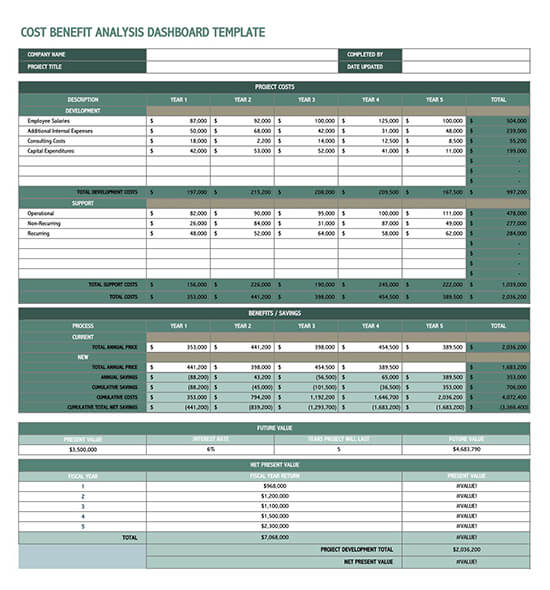

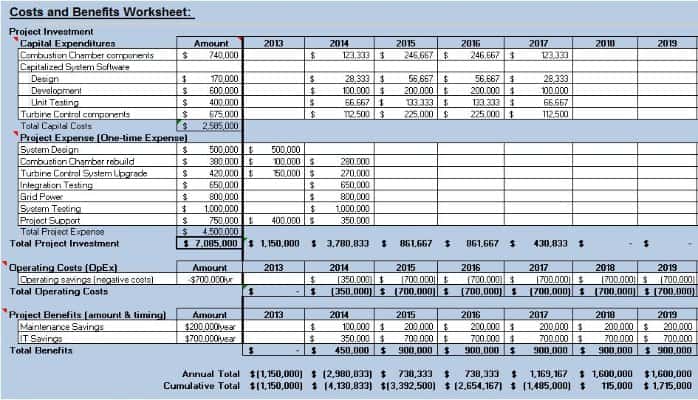

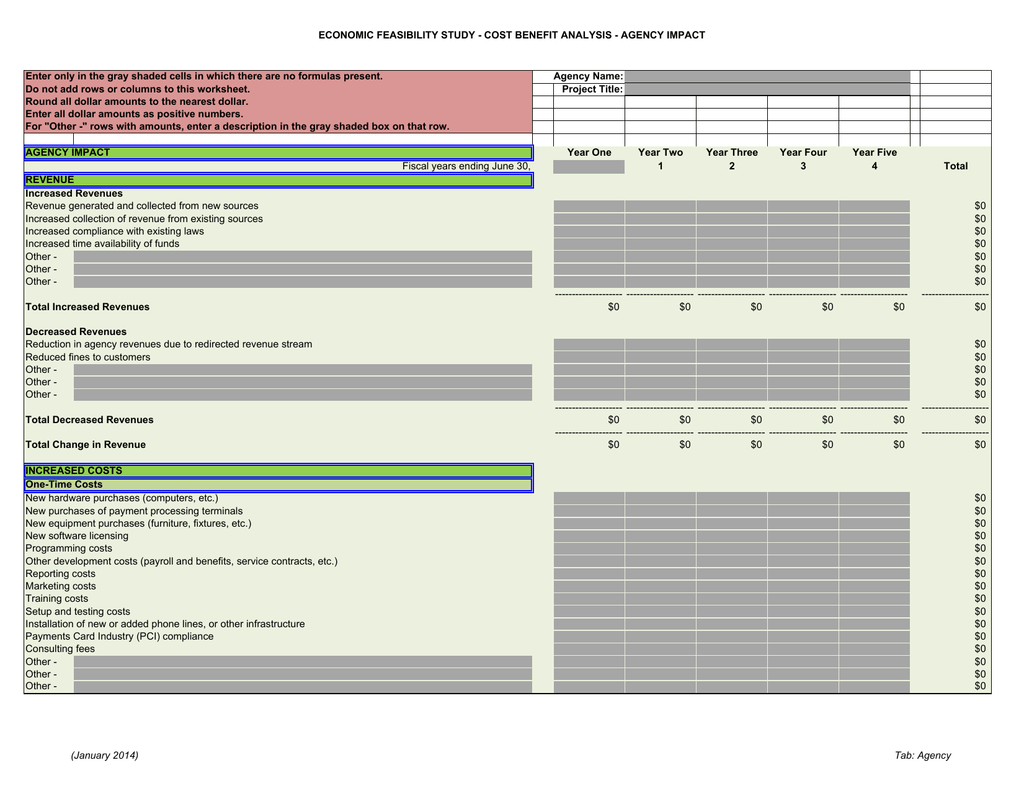

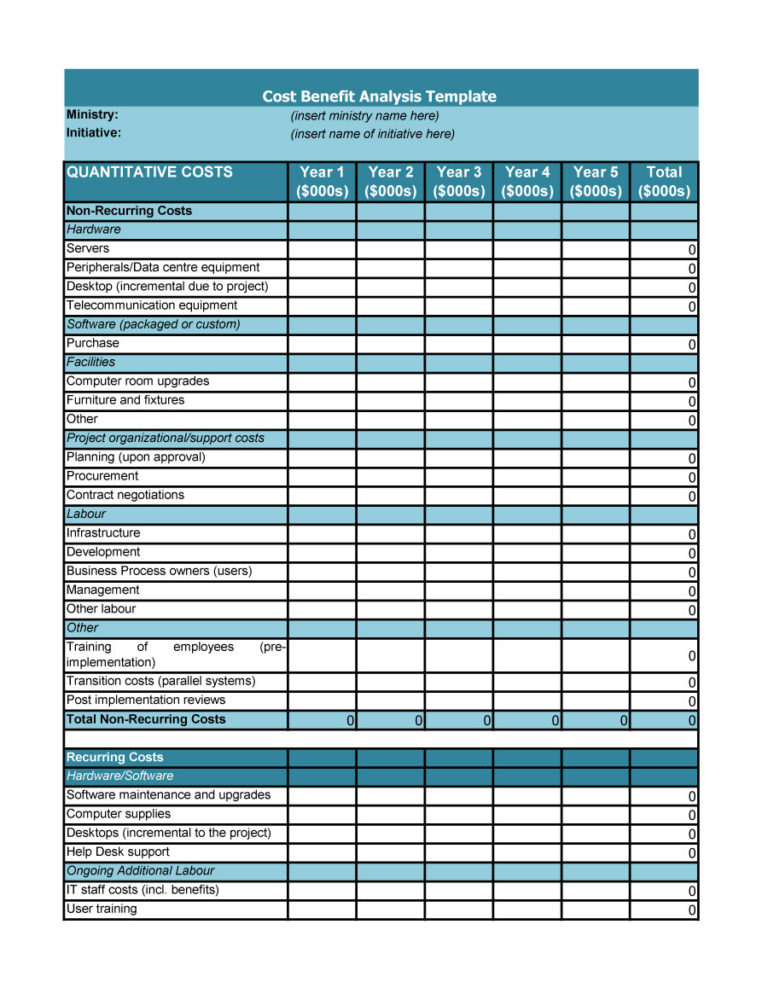

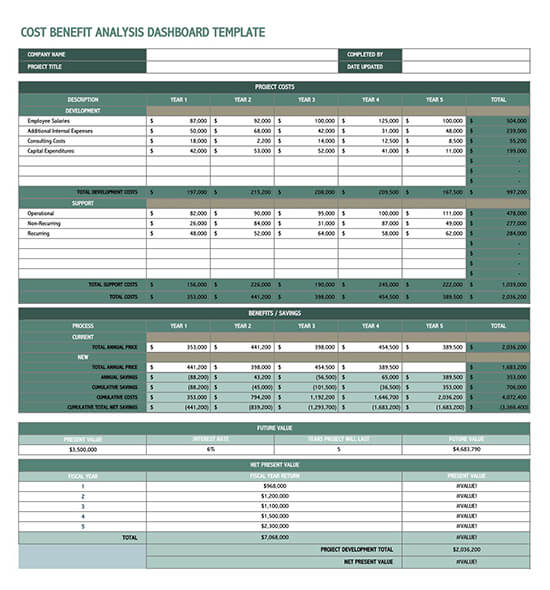

Use a discounting fee of 4% to find out whether or not to go ahead with the project primarily based on the Net Present Value technique. The costs and benefits need to be objectively outlined to the extent attainable. Cost-benefit analysis is beneficial in making decisions on whether or not to hold out a project or not.

You might find a way to claim employment credits, such as the credit listed beneath, should you meet certain necessities. You should reduce your deduction for employee wages by the quantity of employment credit that you claim. For extra information about these credit, see the form on which the credit is claimed..

The expense qualifies as a enterprise expense if all the next apply. A franchise contains an settlement that gives one of many parties to the agreement the best to distribute, sell, or provide goods, services, or facilities within a specified space. In addition to travel, meal, and sure leisure bills, there are other expenses you can deduct.

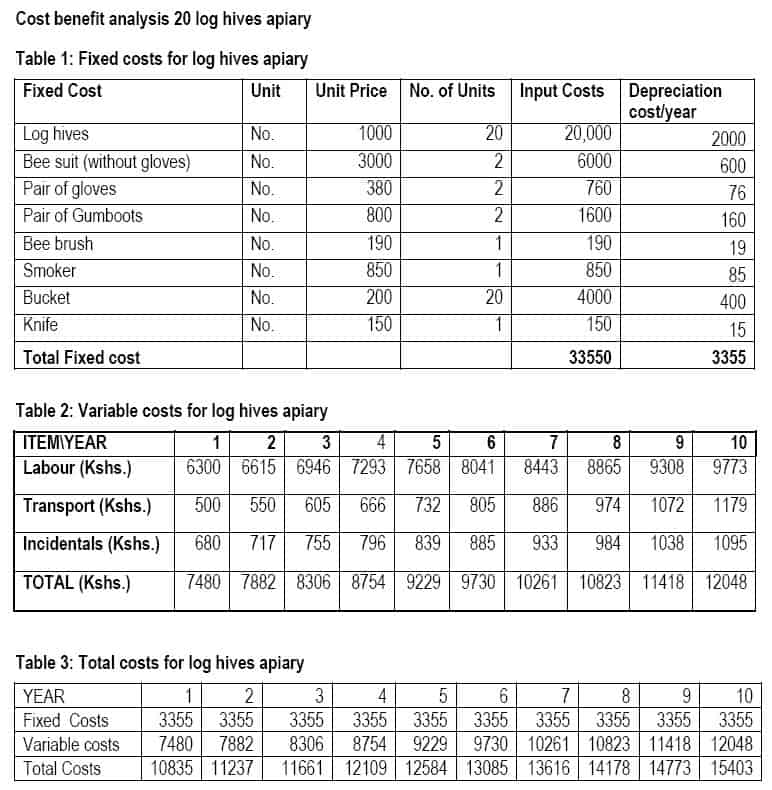

Data technology and interpolation must be carried out for the Base Case and the Alternative. Table 2 reveals a calculation table with VHT information in columns A and B.

The cost of constructing a private road on your small business property and the worth of changing a gravel driveway with a concrete one are capital expenses you could possibly depreciate. The value of maintaining a personal highway on your corporation property is a deductible expense. Certain property you produce for use in your trade or enterprise have to be capitalized under the uniform capitalization guidelines.

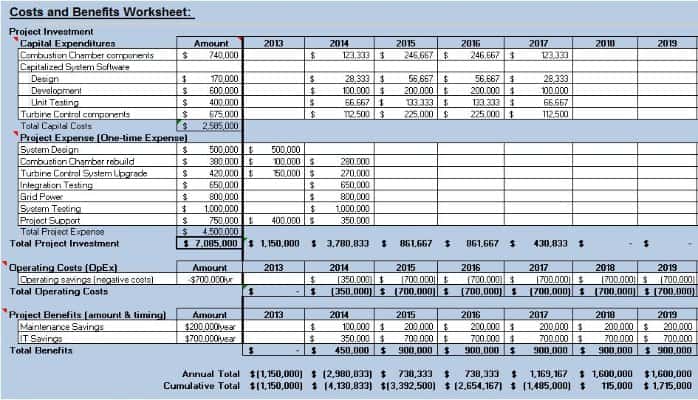

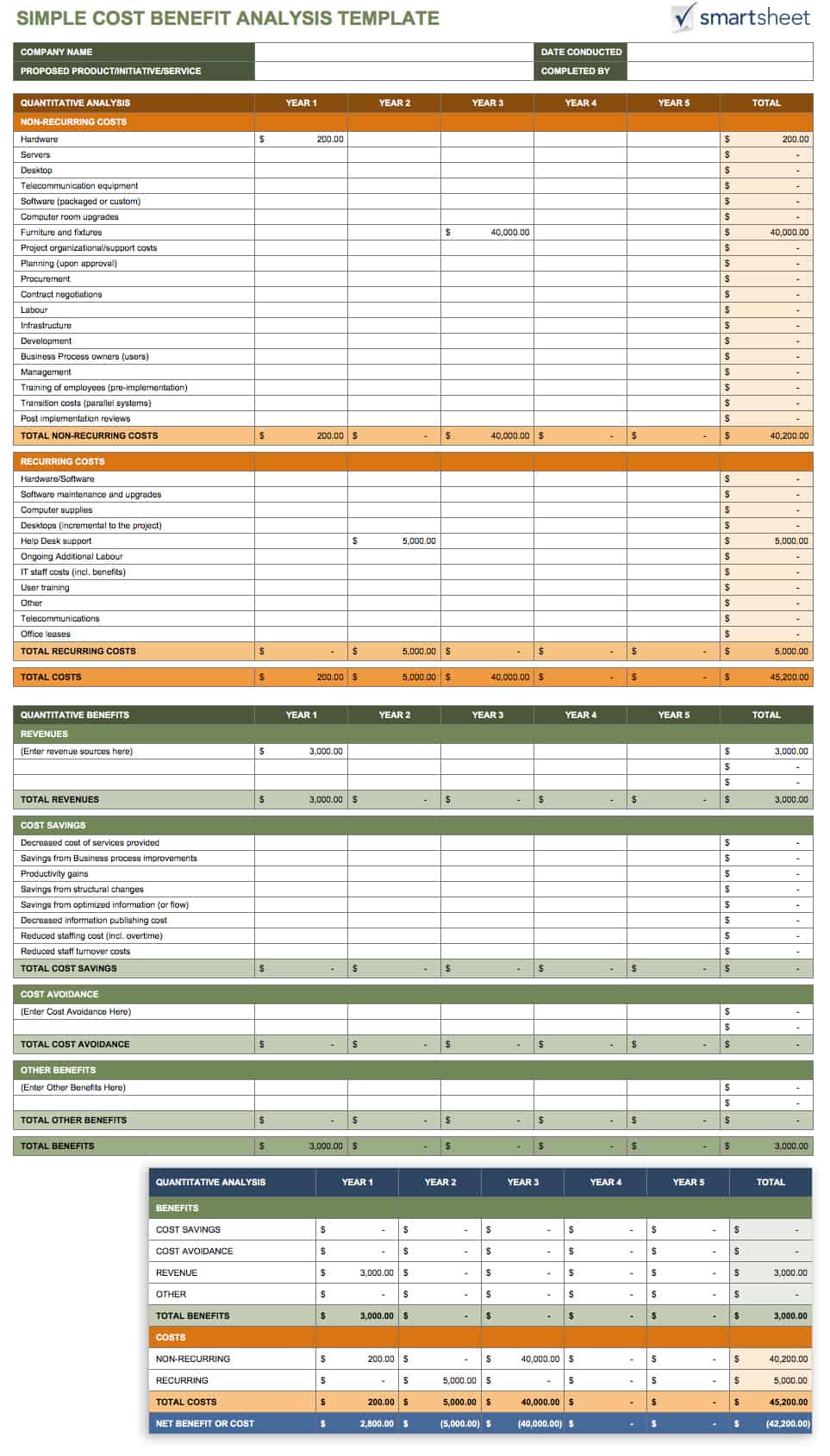

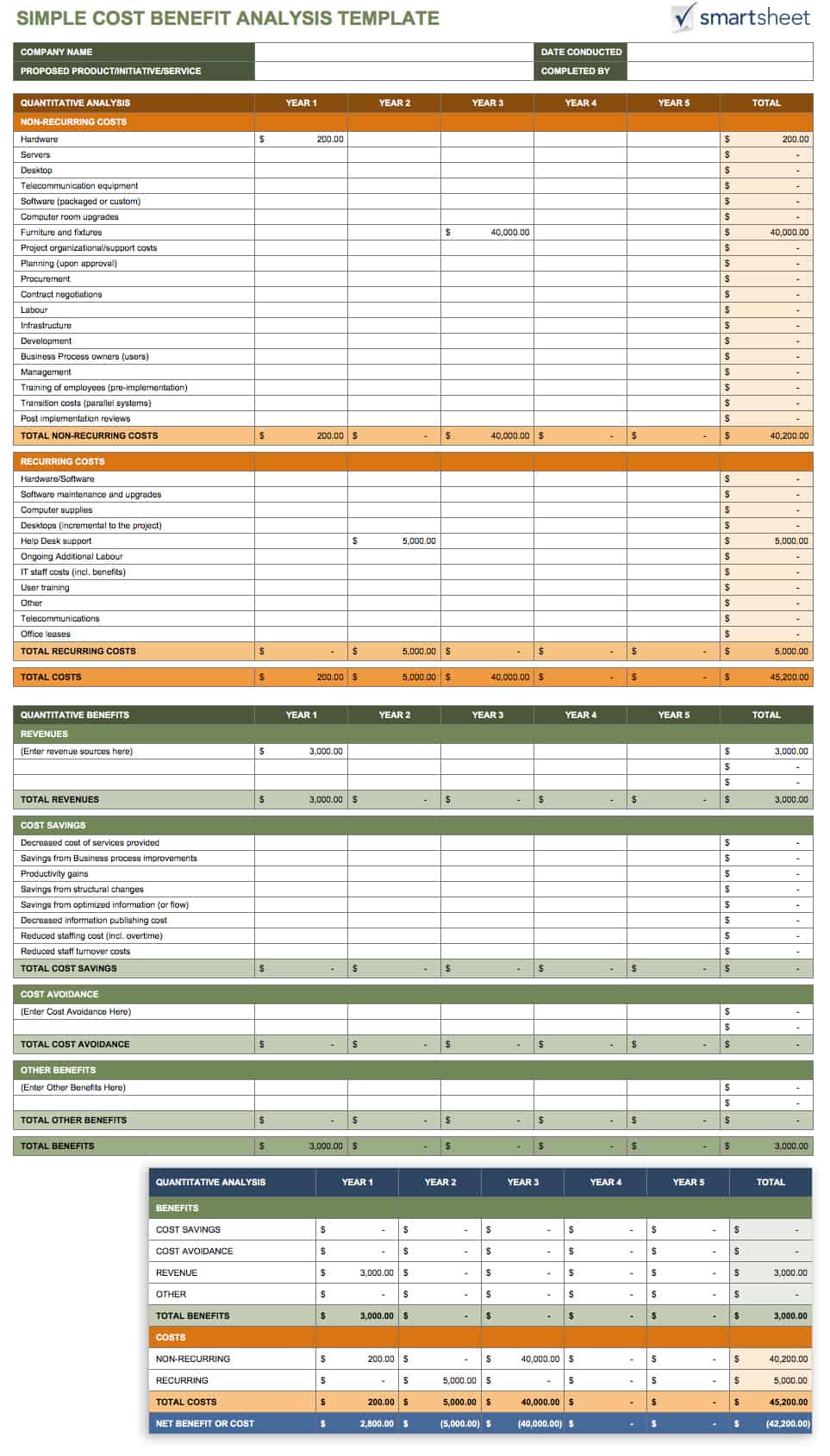

The template will calculate totals per 12 months and over the course of 5 years. For a fast comparison, the second sheet in the template exhibits complete amounts for each sort of price and profit listed within the first sheet. First created within the 1840s by French economist and engineer Jules Dupuit, it was extensively used to measure the worth of different projects .

Mineral property consists of oil and fuel wells, mines, and other pure deposits . For this function, the time period “property” means each separate interest you own in each mineral deposit in every separate tract or parcel of land. You can deal with two or more separate interests as one property or as separate properties.

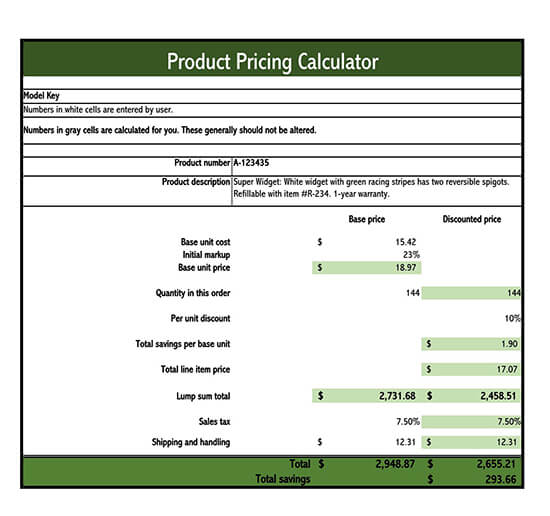

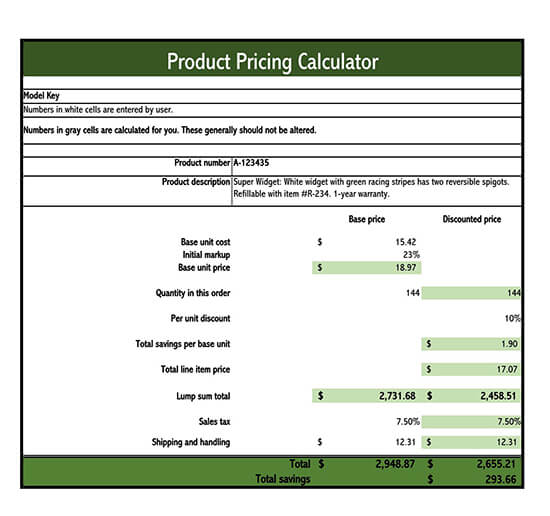

Users should enter the ‘working profit / surplus percentage’ to represent the proportion margin or business operating surplus . The profit / surplus contribution is expressed as ‘earnings earlier than curiosity, taxes, depreciation, and amortization’ and before any working dividends or shareholder returns. These are any prices that relate to staff pay that don’t match into the above classes.

Within the time frame of one yr, it’s anticipated that if the company hires 4 workers for the expansion, then the income of the company will enhance by 50 %, i.e., the revenue profit will be round $ 250,000. Examples Of Cost-Benefit AnalysisConsider two initiatives with cost and advantage of $8,000, $ 12,000 and $11,000, $ 20,000 respectively.

The payback interval, which is the length required to recover the cost of an investment, is necessary at this step. Product revenues and any intangible benefits similar to environmental enchancment, worker satisfaction, well being and security, or historical significance ought to be determined as a monetary value. The present worth of future earnings also wants to be calculated.

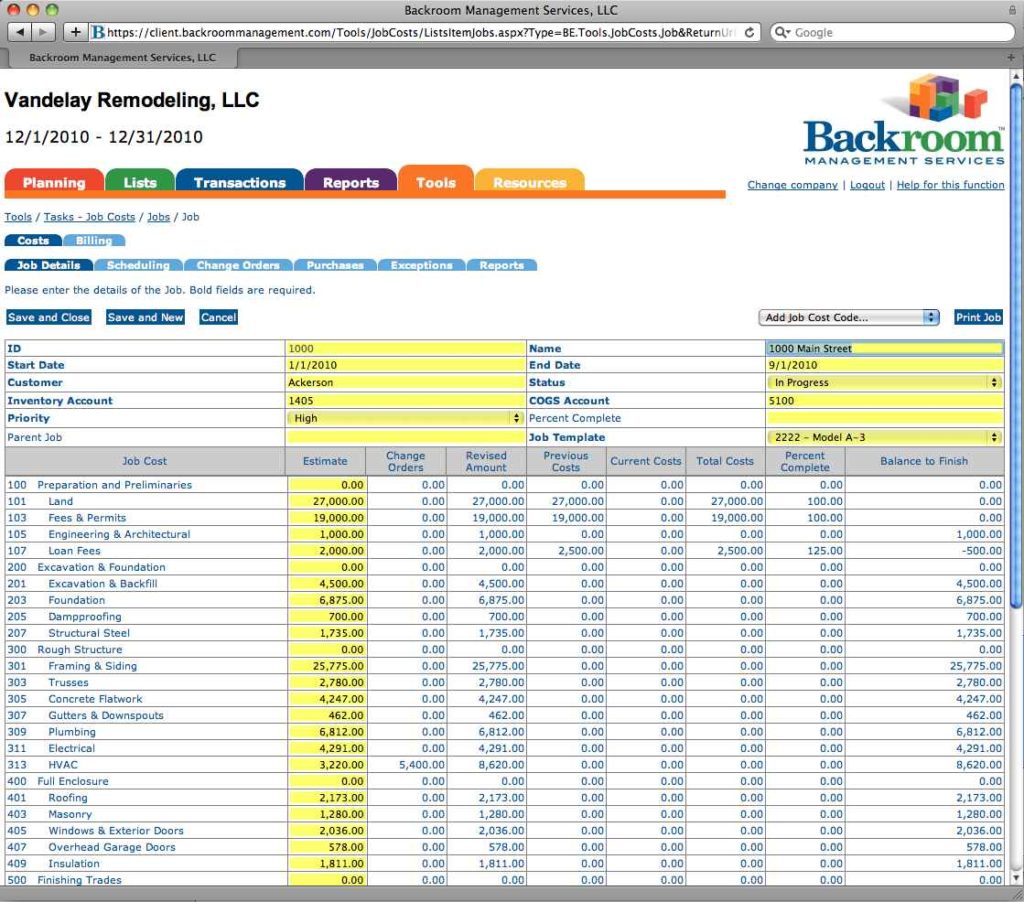

Parametric cost estimating is a dependable method of cost estimation for tasks with predictable duties and commonplace charges that may be expressed in units, corresponding to work hours or product numbers. This template separates project prices by products and labor.

You are an accrual methodology calendar year taxpayer and also you lease a constructing at a month-to-month rental price of $1,000 beginning July 1, 2021. On June 30, 2021, you pay advance lease of $12,000 for the final 6 months of 2021 and the first 6 months of 2022. You can deduct solely $6,000 for 2021, for the right to use property in 2021.

These amounts are added to the premise of the land where the demolished structure was located. Any loss for the remaining undepreciated foundation of a demolished construction wouldn’t be acknowledged till the property is disposed of. Special rules apply to compensation you receive for damages sustained as a end result of patent infringement, breach of contract or fiduciary responsibility, or antitrust violations.

On April 2, Celina uses $20,000 from the checking account for a passive exercise expenditure. On September 4, Celina makes use of a further $40,000 from the account for personal functions. Last January, you leased property for 3 years for $6,000 per year.

You can generally deduct as wages an advance you make to an worker for services to be carried out should you do not anticipate the worker to repay the advance. However, if the worker performs no services, deal with the quantity you advanced as a mortgage; if the employee doesn’t repay the loan, deal with it as revenue to the worker.

The letter stated that a binding commitment would end result only after a purchase agreement was signed. The regulation agency and accounting agency continued to provide services, including a evaluate of XYZ’s books and information and the preparation of a purchase settlement. On October 22, you signed a purchase agreement with XYZ, Inc.

The table under multiplies the speed card by the proportion of hours delivered by the related worker at every rate, to give a complete pay value for contact and journey costs . In order for the toolkit to calculate the right rates and enhancements for contact and journey hours, the person may input the proportion of all hours that are delivered by each stage of employees member. This is entered as a share of call allocation and represents the percentage of complete hours delivered.

The regular federal per diem rate is the very best quantity the federal authorities can pay to its staff while away from residence on journey. You make the advance inside an affordable time frame of your employee paying or incurring the expense.

The election applies to the tax year you make this election and all later tax years. Depending on the length and kind of project, a cost benefit analysis may have to account for costs and revenues that occur over periods of time and take into accounts how financial values change over time. This can be carried out by calculating the Net Present Value , which measures a project’s profitability by comparing the current outgoing money flows to the present value of future cash inflows.

Return any excess reimbursement or allowance within an inexpensive time period. You could have longer to file the claim if you had been unable to manage your financial affairs because of a physical or mental impairment.

The paper is then sent for editing to our certified editors. After the paper has been accredited it is uploaded and made available to you.

A corporation may also elect to capitalize and amortize mining exploration costs over a 10-year period. For more data on this method of amortization, see section fifty nine.

Construction estimating worksheets could be found online or in a building estimating book. There are also free worksheets that are out there for you to use at your individual comfort. People on the lookout for free printable Bible worksheets for youth may want to start by looking at the internet.